£2.5m Heavy Refurbishment Loan For Office To Residential Conversion

£2.5m heavy refurb loan for office to resi conversion

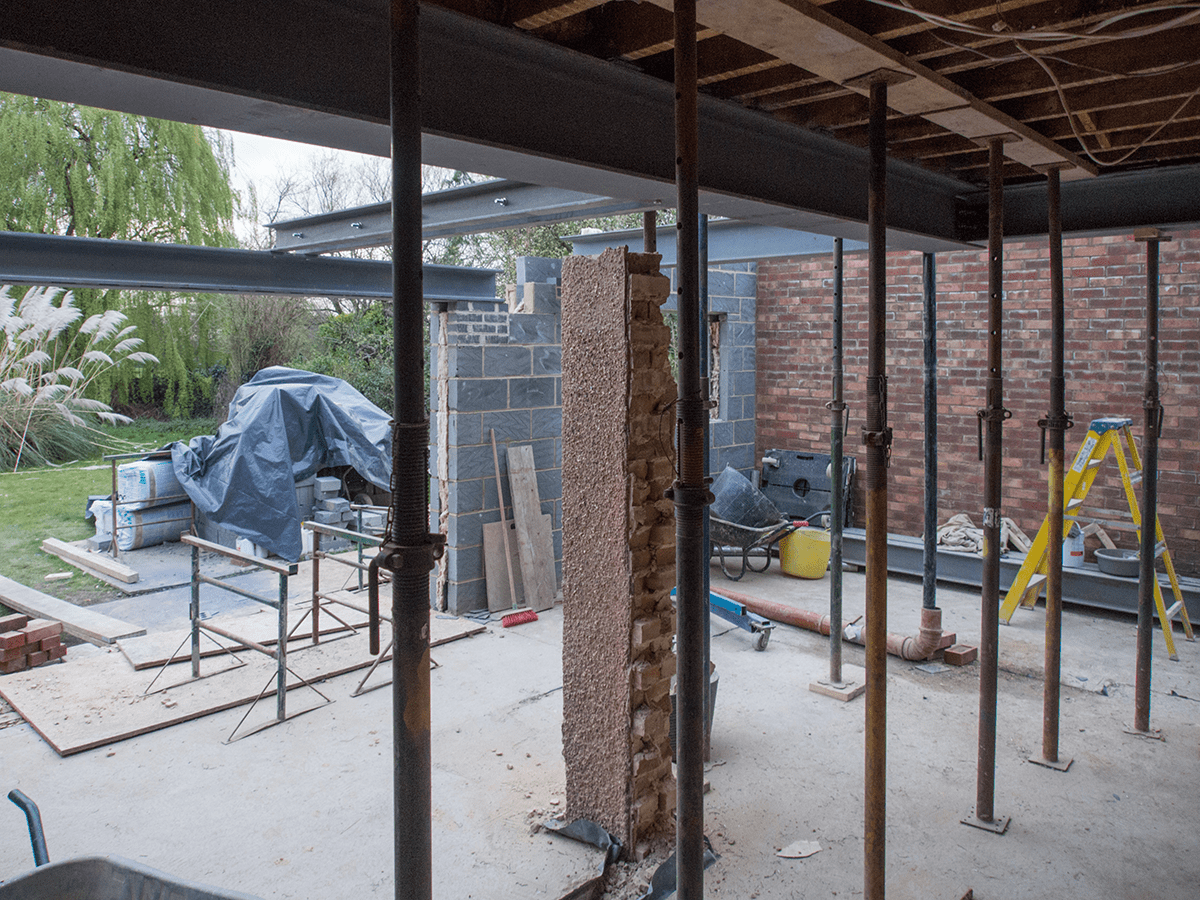

Situation: A client with an established BTL portfolio was looking for a loan to purchase a 5-story office building with consent to convert the top 4 floors into 16 apartments. The ground floor would remain a commercial unit. After another lender pulled out, the borrower contacted Catalyst, urgently needing the bridging funding so as not to miss out on the opportunity.

Target: To produce competition Heads of Terms for the bridging loan, proceed the application, completing all valuations/QS reports/legal requirements as quickly and efficiently as possible to enable the borrower to have the funds within the agreed purchase deadline.

Action: The Catalyst team established there was an issue with the title layout which is why initial funding had fallen through. 10 years ago, the title was one freehold building but was then split into two freeholds. The half of the freehold our client was purchasing was not reviewed correctly. With the help of our solicitors, this was quickly rectified. Valuations and estimated incomes were checked and stress-tested in the market and found to be accurate.

Result: Catalyst was able to complete the application and release funds within the timescale needed enabling the borrower to meet their purchase deadline.

QUICK LOAN OVERVIEW:

- Purchase of a 5-storey office building for £1.25m

- Consent to convert top 4 floors into 16 apartments

- Estimated build cost £1.4 million

- Estimated GDV £4.4 million

- Estimated rental income £217,80 per month

- 18-month term, 12 months to convert the property and 6 months to refinance.

James Farge, Catalyst Sales Director says: “To get a heavy refurb facility completed within 21 working days including full legal DD, QS and valuation reports is no mean feat in the current market. It just shows that when you have an experienced, motivated borrower who surrounds themselves with the right team, great things can happen. I am excited to see the progress of the build and we are already on to the next deal with the borrower which we will fund in February.”

Martyn Balsom, Senior Credit Analyst says: “Completion in 21 days is a massive achievement, however, we could not do this without a highly motivated client and the assistance of a very good broker and solicitors who were all at the top of the game. Memery Crystal pulled out all the stops to help us meet the borrower’s deadline”.